GSTR-2B Reconciliation Accurate ITC Claims

Automate GST Workflows. Maximize ITC. Stay 100% Compliant.

From seamless eInvoicing to intelligent 2B reconciliation, VastPRO’s GST-ready tools reduce manual effort, ensure government compliance, and eliminate credit leakage - all with zero licensing burden.

VaZt GSTR-2B Reconciliation

The Problem

GSTR-2B data holds the key to your Input Tax Credit - but manual reconciliation wastes time and loses money.

Common issues include:

Missed or delayed vendor filings blocking ITC

Endless Excel comparisons and VLOOKUP headaches

Errors in Reverse Charge Mechanism handling

Credit/Debit notes not netted off against invoices

Missing carry-forward tracking for unresolved mismatches

Mismatch or missing GSTIN or Documents

These gaps can cost you lakhs in unclaimed credit.

Our Solution

VaZt GSTR-2B Reconciliation automates the entire process so you can:

Upload purchase data via Excel, CSV, API, or ERP integration

Download multi-month 2B JSON directly from GSTN

Auto-match invoices with exact, partial, or fuzzy logic

Identify mismatches instantly - including Place of Supply issues

Get vendor-level reconciliation for faster follow-ups

Reconcile RCM entries separately for compliance clarity

Net off Credit/Debit Notes against matching invoices

Carry forward unresolved mismatches automatically to the next cycle

Key Features

Why Choose VastPRO

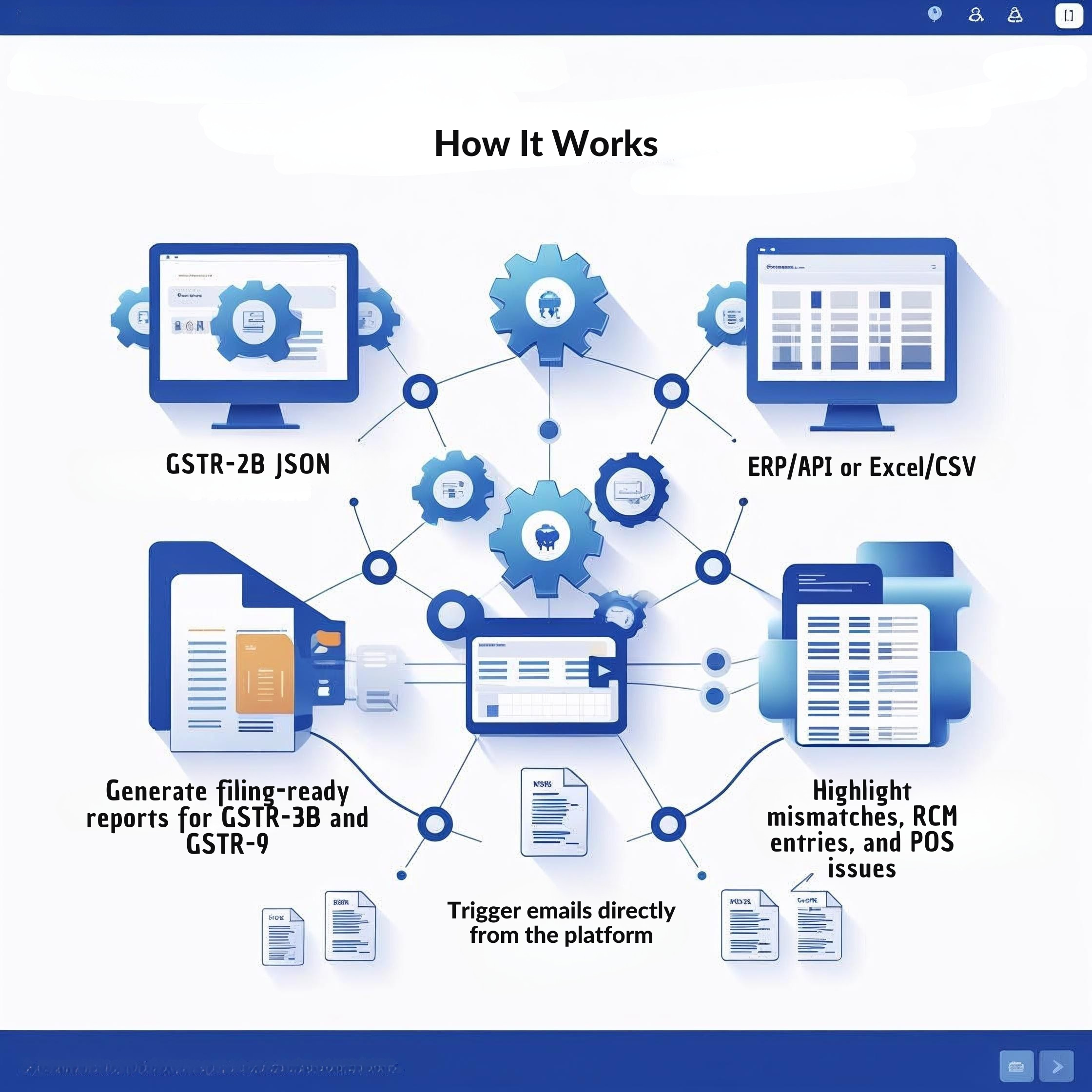

How It Works

Results You Can Expect